While we navigate through evolving strains, manage the rising number of cases, and rapidly rising use of digital facilities but constantly looking forward to offline experiences, one thing’s for sure – there’s no turning back. This a surprise, with 68% of companies having no idea what to do once the pandemic is over. They are merely trying to survive.

In this guide, you won’t learn how to survive but instead thrive – in this new normal.

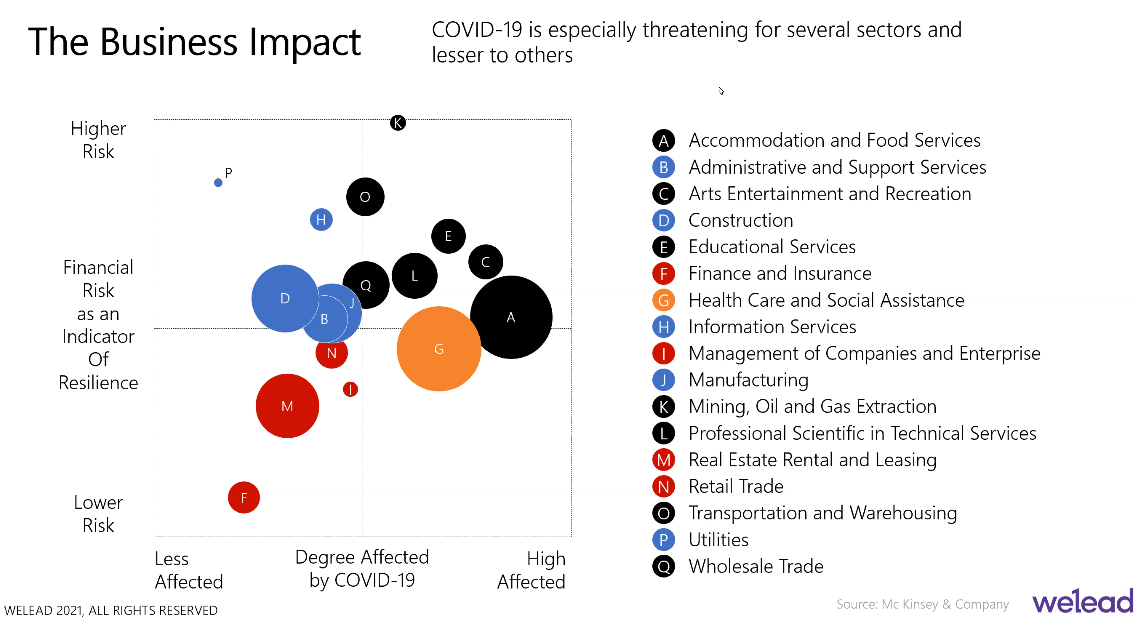

The Impact of the Pandemic on Businesses

Source: Melvin Esteban (CEO of WeLead), How to Thrive in the New Normal, Zoom Webinar, November 4, 2021

- The higher the business sector is in the quadrant, the higher the financial risks are.

- The farther it is to the right, the more the business is affected.

- The most affected industries are the ones where more people are involved: Accommodation and Food Services, Arts, Entertainment & Recreation, Educational Services, Mining, Oil & Gas Extraction, Professional Scientific in Technical Services, Transportation and Warehousing, Wholesale Trade.

- Business sectors like Finance and Insurance, Management of Companies & Enterprises, Real Estate Rental & Leasing, and Retail Trade are less affected and pose lower financial risks compared to the other sectors.

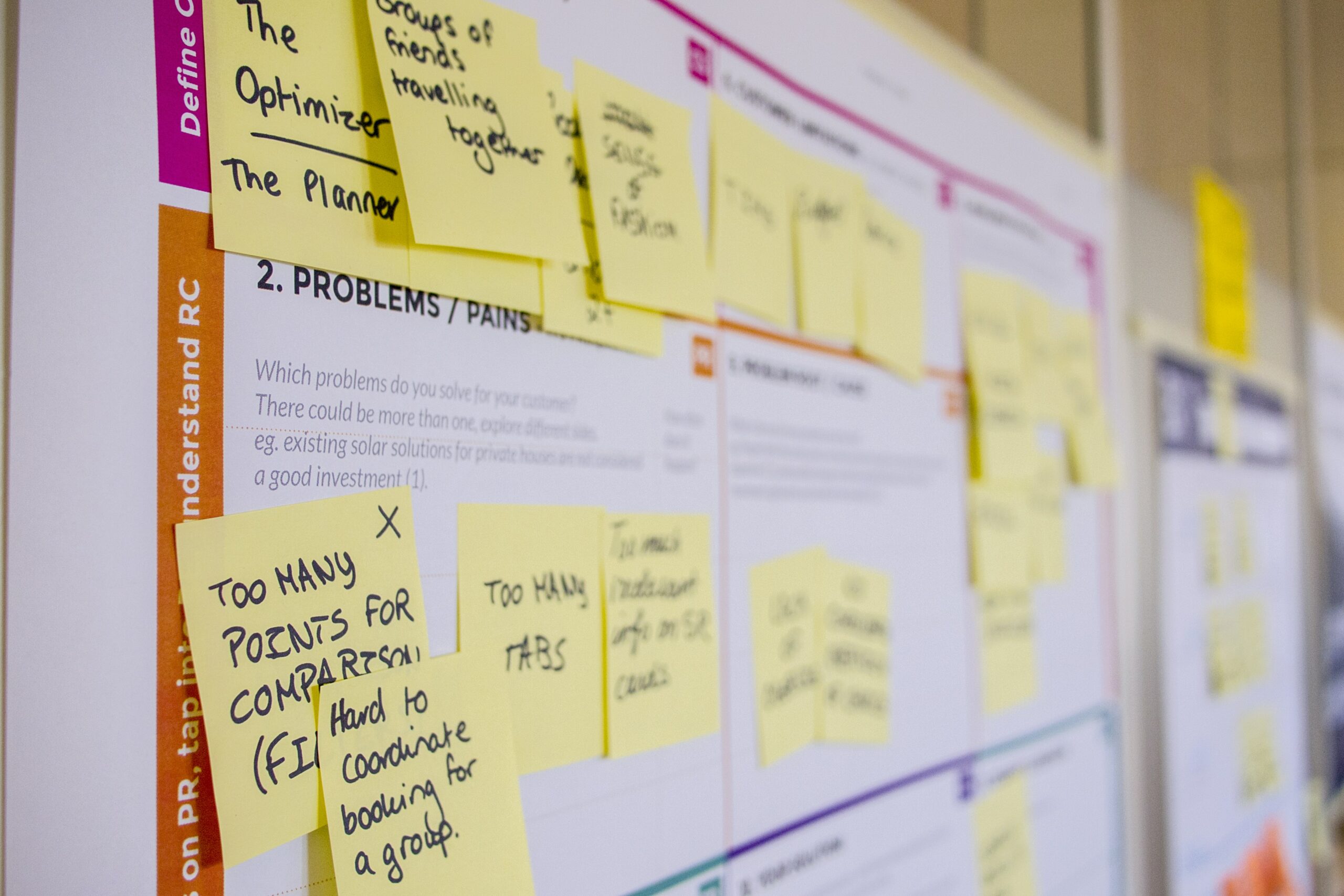

Consumer Behaviors That Changed and will Stick Because of the Pandemic

Source: Melvin Esteban (CEO of WeLead), How to Thrive in the New Normal, Zoom Webinar, November 4, 2021

What to do with these trends?

Look at employee wellness with a hybrid workforce. Even as cases slow down, continuing to allow employees to have a choice to balance their work attendance (on-site or from home) promotes a healthier and trusting working environment.

This is also an opportunity to review employee group health insurance that adapts to this new workforce set up.

Make it entertaining. Make it organic. Short-form video content (thanks to Tiktok), photos and videos created just from your phone are a great way to promote your products and services.

User-generated content has been known to be very effective in reaching out to customers as it’s more relatable, by nature. And this is now more amplified today.

Market in new channels. Try influencer marketing. Social media marketing, on its own, has become well known for being a cost-efficient channel to generate sales. But it is a very crowded space.

Tapping influencers can help provide more authentic endorsement for your products and services, to encourage sales. Explore invitations from micro-influencers, and establish a network to reach groups – niche, but highly engaged.

Protect your digital assets including customer data. Once you start selling online, you gather customer data, you store information in cloud systems, and even store financial data virtually. As you would on ground, online information needs to be kept securely and documented for easier retrieval.

It’s also expected that data privacy policies and regulations will continue to increase, as we’ve already witnessed with iOS updates allowing its users to choose how its online consumption is tracked. Make sure to review your control, security and storage protocols for online, along with your data privacy policies.

To boot, this is a great way of improving your trustworthiness for prospects you draw from online. The better you show a prospective customer how trustworthy you are, the more likely they are to convert.

Source: https://www.rappler.com/hustle/work/digital-marketing-trends-small-businesses-should-know-2022/

Provide customers an omni-channel experience i.e. seamless experience from online to offline, from one channel to the next. The reality is people can be anxious to go out to buy in-store, and will choose to go online.

It’s time to look at all available channels based on the audience that are drawn to it, and implement strategies as a whole. Leverage the strength of each channel according to its audience it captures. Study the channels, test, before going onboard in full, to help optimize your resources.

The thing to remember is having the ability to access certain services and products from online to offline, and back.

Source: https://www.rappler.com/hustle/work/digital-marketing-trends-small-businesses-should-know-2022/

Innovate, streamline and be agile. Businesses, of any size, are able to drive and sustain growth during this time by equally being very dynamic.

Always testing possible routes, quickly identifying strategies that work, then scaling. Rapid business growth is of course, a great outcome, but it can come at a cost without the right protection.

Take the time to review your business assets and insure those that are integral to your business. Some of the insurance types that are relevant in our new normal are:

- Employee Health Insurance

- Inventory Insurance

- Shipping & Cargo Insurance

- Cyber Liability Insurance

- Product Liability

- Motorcycle Insurance

Uniguarantee Insurance Brokerage, Inc. works with a wide network of insurance providers to provide a comprehensive and tailored solution for its clients – businesses of different sizes.

With its insurance network and over 100 years of combined experience, you can be rest assured that you’re with a team you can trust – a partner who takes care of you and your assets, while you take care of growing your business.